FAQs: 2025 Overtime Tax Deductions

GENERAL OVERVIEW

Q: What is the new overtime tax deduction for 2025?

A: A new federal tax deduction allows eligible employees to deduct a portion of their overtime pay earned in 2025 when filing their federal income tax return.

Q: Who is eligible for this deduction?

A: Employees who are eligible for overtime under the Fair Labor Standards Act (FLSA). This generally applies to non-exempt hourly employees.

Q: Does this affect my 2025 W-2?

A: No. Your W-2 will not show a special line for this deduction. The IRS does not require employers to separately report qualified overtime for 2025.

REPORTING & PAYROLL

Q: Will my employer calculate this deduction for me?

A: No. Employees are responsible for calculating and claiming the deduction on their personal tax return.

Q: Will this change how my employer withholds taxes?

A: Not automatically. Your employer will continue withholding based on your current W-4 unless you submit a new one.

Q: Is there anything new on my pay stub?

A: No. You will use your existing overtime amounts shown on your pay stubs.

WHAT PART OF OVERTIME IS DEDUCTIBLE

Q: Is all overtime pay deductible?

A: No. Only the overtime premium portion is deductible — the extra 0.5 rate, not the full 1.5× amount.

Example:

If your regular rate is $20/hour and overtime is paid at $30/hour:

Only the extra $10/hour qualifies, not the full $30.

HOW TO ESTIMATE YOUR QUALIFIED OVERTIME

Q: How do I estimate my qualified overtime amount?

A: For a simple estimate:

- Find your Year-to-Date Overtime Earnings on your final 2025 pay stub

- Divide that total by 3

This approximates the 0.5 premium portion.

Q: Can you give a simple example?

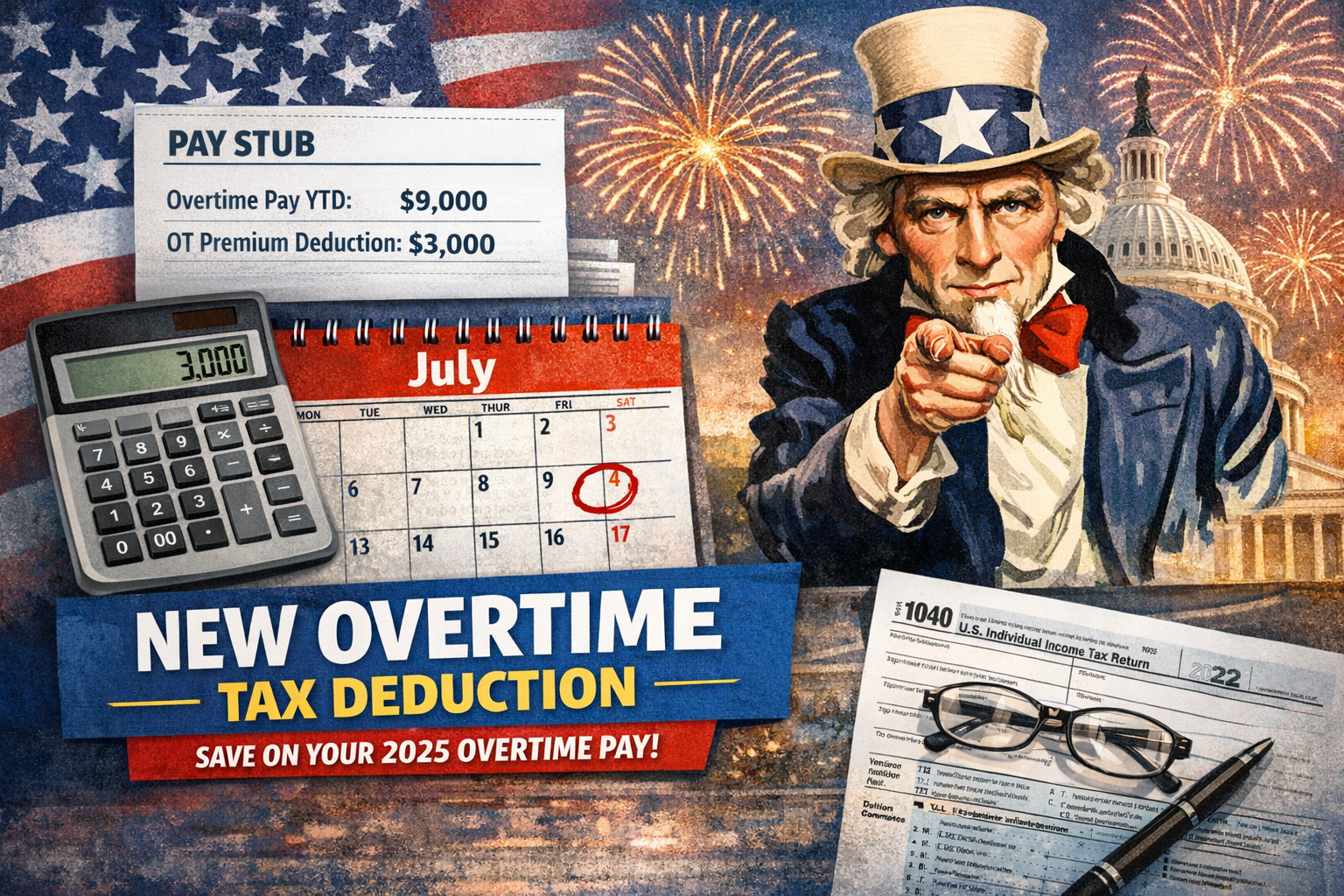

A: Overtime earnings for 2025: $9,000

$9,000 ÷ 3 = $3,000

Estimated qualified overtime deduction: $3,000

IMPORTANT LIMITATIONS

Q: When does the divide-by-3 method NOT work well?

A: This estimate may be inaccurate if you have:

- Double time

- Shift differentials

- Bonuses affecting your regular rate

- Blended or weighted overtime rates

- Special pay structures

In these cases, a tax professional should calculate the exact amount.

FILING YOUR TAX RETURN

Q: How do I actually claim this deduction?

A: You claim it when filing your 2025 federal income tax return, using your own records and pay stubs.

Q: Will tax software handle this?

A: Most major tax software platforms are expected to support this deduction, but you will still need to enter the correct amount.

WITHHOLDING FOR 2026

Q: Should I update my W-4 for 2026?

A: Possibly. If you expect ongoing overtime and want to reflect this deduction in your future withholding, you can submit a new 2026 W-4.

Q: Where does this go on the W-4?

A: The Deductions Worksheet in Step 4(b) can be used to account for this deduction.

Q: What happens if I don’t submit a new W-4?

A: Your withholding continues based on your current W-4.

Important Reminder: We are not certified tax professionals. This information is provided for general awareness only and should not be considered tax advice. Because individual tax situations vary, we strongly encourage you to consult a qualified tax professional before making tax-related decisions.