Empowering

Non-Profit Organizations

Simplify your payroll and reporting requirments with Time & Pay's superior service

Why Non-Profit Organizations Choose Us

01

Service

We'll tailor our services and develop a process that makes payroll simple for you, even if that means more work for us. We'll help you, so you can focus on helping others.

02

Compliance & Reporting

Our payroll services for non-profits provide essential payroll and labor information required by grant and insurance audits, and we guarantee payroll tax compliance!

04

Employee Retention

We can provide your employees with financial wellness tools and immediate earned wage access, which relieves financial stress and increases productivity!

Using Time & Pay made managing payroll and taxes so easy. It was the best decision our company ever made! Our dedicated rep is on top of everything. If we make a mistake, he usually catches it before we realize we did anything wrong. We couldn't function efficiently without them.

Christina P.

Get Pricing Today

Ready to simplify your payroll and HR processes? At Time & Pay, we tailor our services to meet your unique needs. Let us show you how we can add value to your business. Get a quote now and decide if you'd like to continue the conversation!

How We Help

Payroll & Tax Services

Efficient payroll processing tailored to your needs with guaranteed compliance.

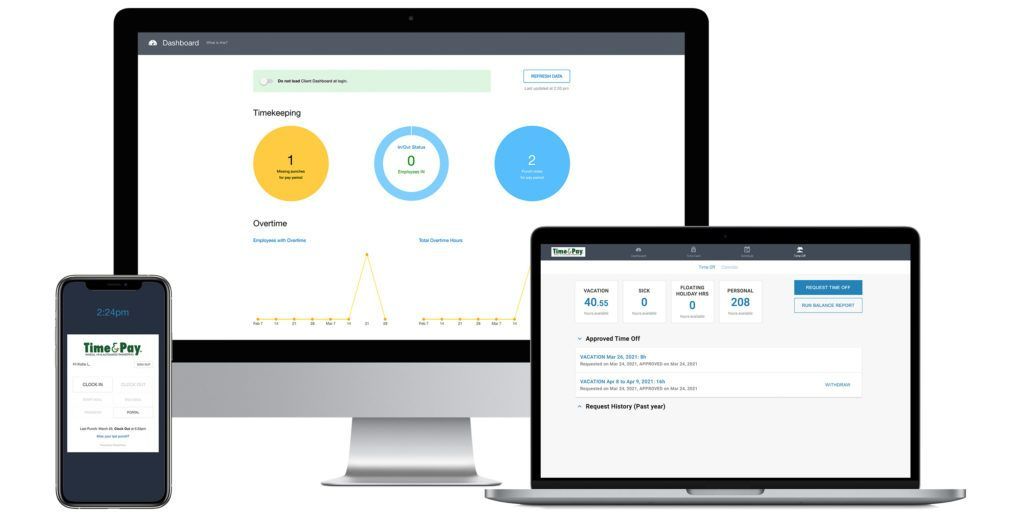

Time Management Systems

Human Resources Management

Cloud-based HR tools and complimentary consultation for your business.

Benefits & Insurance Management

Benefits enrollment, administration, and compliance tools

Payroll for Non-Profits Tailored To Your Needs

Tailored Payroll Solutions with Guaranteed Tax Compliance

Tools That Empower Employees

Save time and enhance your team's potential with intuitive digital tools and valuable benefits, featuring straightforward, self-guided onboarding and flexible payment choices.

Tools That Save You Time and Money

Our solutions prevent time theft by removing the practices of "rounding" and "buddy punching." Additionally, we proactively help you reduce overtime through alerts and intuitive scheduling solutions.

Exceptional Customer Service

We Make Switching Easy

Consultation

We learn about your company, and what your ideal process looks like.

Information

We gather required information as efficiently as possible and try to minimize your time investment.

Confirmation

We'll confirm when we're ready to process, and work with you directly to ensure accuracy.

As a former customer of one of those big national firms, not only does Time & Pay perform better in the payroll processing area with better products and services, but you are also way ahead of them in the customer service area. It is a pleasure working with your staff knowing that any help we need is readily available.

Vanessa S. - CCS

FAQs

How much do payroll services cost for a non-profit?

Get PricingThe cost of payroll services is typically based on the number of employees on payroll. Your pay frequency, your location, and the services that you utilize may also impact pricing. Time & Pay provides transparent pricing to help give you an idea of what payroll services will cost.

What's the best way for a non-profit to do payroll?

The best way to do payroll for a small business depends on your needs and budget, but you can consider outsourcing the process, using payroll software, or hiring a payroll specialist.

Regardless of whether you're processing payroll yourself, or using a payroll company, you'll still need these items:

- EIN and State Tax Accounts

- W4 and I9 for all employees

- Consistent pay frequency and check date

- Tax filing requirements and deadlines

- Record keeping requirements

Can a non-profit do their own payroll?

Though time consuming and often complicated, employers do have the ability to handle tax filings and returns through The Electronic Federal Tax Payment System (EFTPS), can pay employees via check, maintain employee records within their filing systems, and produce year-end forms for their employees without the assistance of a payroll processing company. More often than not, however, the peace-of-mind and time savings that outsourcing payroll responsibilities provides far outweigh the cost of those services. Non-compliance with tax and labor regulations can also be significantly more expensive than the cost of outsourcing payroll.

How do I process payroll for my non-profit?

Regardless of who is doing it, processing payroll consists of the following steps:

- Track and record employee hours worked

- Calculate wages and withholding amounts (taxes, benefits, etc.)

- Distribute wages to employees

- Deposit the withheld taxes with appropriate government agencies

- File employer tax returns at the applicable deadlines

- Send employees Form W-2 and other required tax forms

What are the benefits of outsourcing my payroll?

Businesses usually outsource their payroll in an effort to save time, reduce labor costs, and maintain compliance with tax and labor laws. Payroll is not a revenue-generating aspect of your business, so the more time you spend on processing payroll, the less you are able to focus on growing your business. Outsourcing payroll can also offer peace-of-mind knowing that employees will be paid and taxes will be filed on time and accurately.

Are payroll requirements different for each state?

Each state can have its own tax requirements and labor laws. For example, certain states have state income taxes, while others do not. Regardless of where your company is located, Time & Pay can help keep you compliant with local regulations.